Commercial Real Estate

Over the past decade, significant regulatory reforms have accelerated the formalization of the Real Estate sector, making it more attractive to investors. Among various asset classes in the sector, Commercial Office has emerged particularly appealing, driven by robust demand for Grade A office spaces, improvement in urban infrastructure and educated workforce.

Effectively managing these assets is essential to attract investments, maintain high occupancy rates, and deliver long-term value to stakeholders. Achieving this requires a specialized operational framework built on three core pillars: expert teams, streamlined processes, and global benchmarking.

Our Rental Yield Plus strategy has established a strong operational foundation for managing commercial office spaces, delivering excellence through:

- Disciplined Asset selection: Conducting meticulous due diligence at the acquisition stage

- Experienced Asset Management Team: Deploying a seasoned team with extensive expertise to actively manage and oversee property operations

- Proven Processes with Global Standards: Implementing industry leading best practices abide by international benchmarks, ensuring consistency and quality

- Technology-Driven Solutions: Leveraging cutting-edge tools and automation to streamline operations, improve tenant experience, and maximize returns for stakeholders.

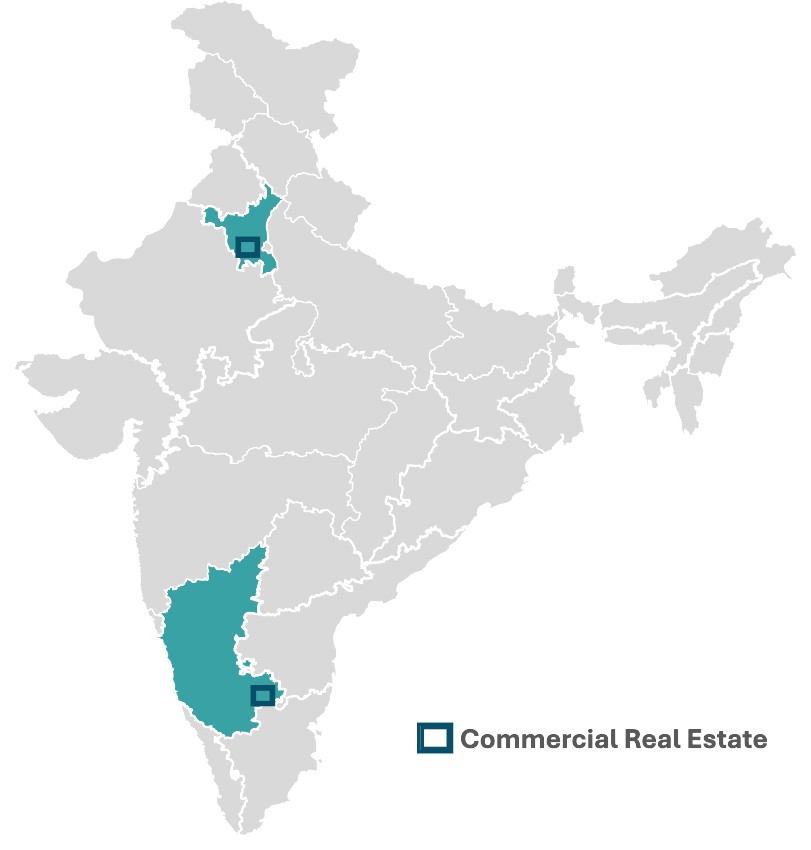

Strategically Located Office Assets

The fund currently oversees a portfolio of premium commercial assets, including properties in two of India’s top seven metro cities: Gurgaon and Bengaluru. These Grade-A developments cover around 1.8 million square feet, with a weighted average lease expiry (WALE) of 4.0 and 8.5 years, respectively. With a robust and varied tenant base, our strategy focuses on maintaining a careful balance between long-term lease agreements and market-to-market opportunities, ensuring both stability and growth potential.

Asset Management Strategy

Our asset management strategy is built on proactive operations, data-informed insights, and a strong grasp of commercial real estate trends. We actively monitor and maintain each property to meet global standards, prioritizing consistent performance and tenant satisfaction. Our upgrade program includes the implementation of integrated technology solutions designed to enhance building performance and elevate the tenant experience.

As we continue to grow our portfolio, we remain committed to disciplined asset management—ensuring every property is optimized for value creation, long-term sustainability, and strong investor returns.

Leadership

Shantanu Chakraborty

Managing Director – Commercial Real Estate Portfolio

Our Portfolio

Commercial Real Estate

- 1.8 mn Sq. Ft Gross Leasable Area

- 2 Cities

- 94% Current average occupancy

- 25+ Top Tier Domestic and International Tenants